11Graphs on Twitter: "2/ Best managed companies among the most reputable by EBITDA RoIC: 1. 🇺🇸 MICROSOFT $MSFT: 155.4% 2. 🇺🇸 NIKE $NKE: 65.8% 3. 🇺🇸 GOOGLE $GOOGL: 64.4% 4. 🇯🇵 NINTENDO $NTDOY: 57.6% 5. 🇯🇵 SONY $SNE: 47.2% https://t.co ...

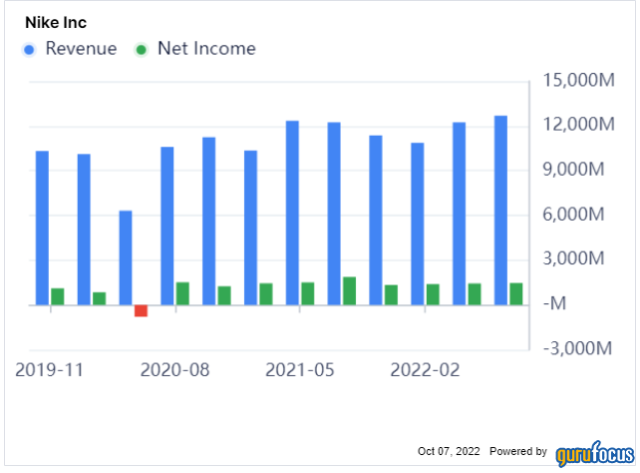

Earnings Reveal a Loss of Pricing Power and Valuation Risk for NIKE, Inc. (NYSE:NKE) - Simply Wall St News

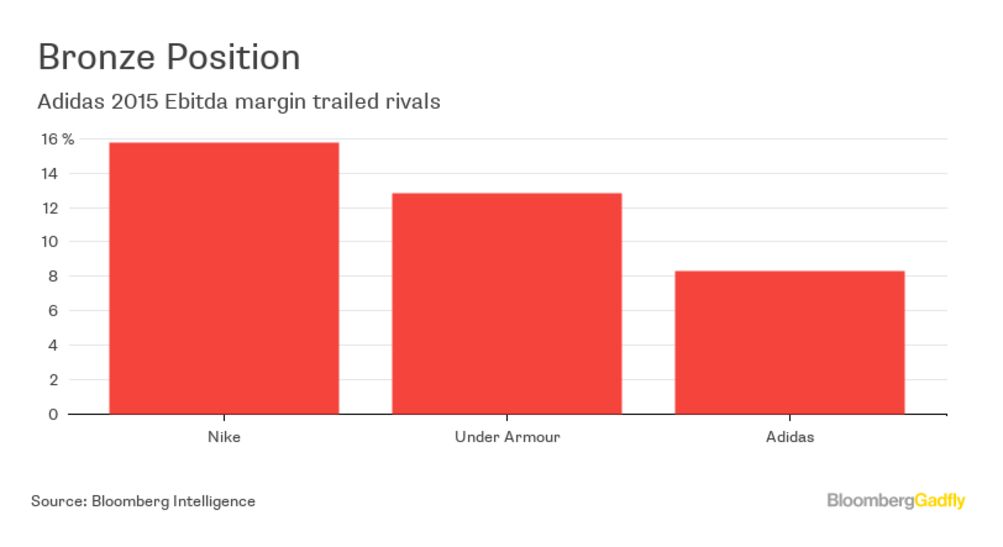

adidas originals heren shoes sale free online ADV 'adidas bali series large print fabric for wall art' - BY4367 - adidas ebitda margin ratio chart | UhfmrShops

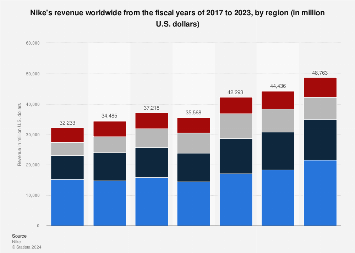

Nike Common Stock Valuation - May 24, 2010 Nike Common Stock Valuation As of May 24, 2010 By Valentyn Khokhlov, MBA. - ppt download